Working with Global Brands

In a crowded marketplace, every brand is competing for attention, but there is a difference between fleeting recognition and lasting influence. We deliver PR with tailored strategies that enhance your reputation, drive growth, and support your business goals—because noise alone isn’t enough, you need impact.

Whether it’s shaping your profile, increasing exposure, engaging your audience, or delivering your message effectively, our teams are committed to making it happen.

Our Integrated Services

We bring fresh insights to every client’s brief, crafting tailored programs that capture a brand’s values, and personality. Our integrated approach clarifies the message, amplifies the story, and expands opportunities. By combining PR, content, and growth marketing strategies, we build reputation and accelerate growth.

We put people first and we don’t compromise on empathy, ethics, and genuine connection. We're here to truly understand and support our clients and our team - making sure our work is in sync with values, goals and aspirations.

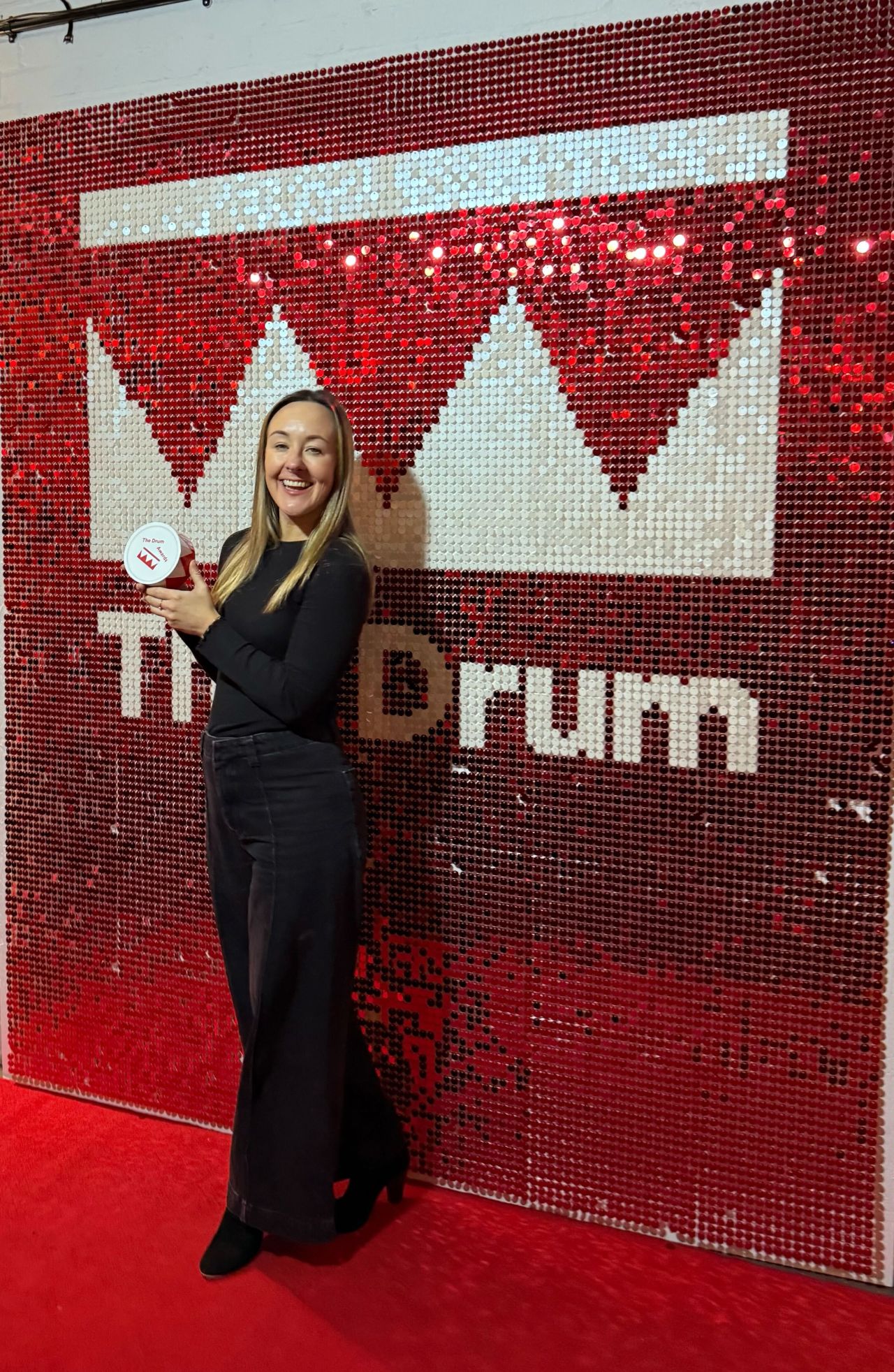

A great place to work

- PR Week Top 100 2024

- Sunday Times Best Places To Work 2024

- Campaign Best Places To Work 2024

- Creative Pool Best Agency To Work For 2024

- IPA People First Award

(3).avif)

.avif)