New business needs strategic planning to succeed – and that means practitioners need the ability to benchmark against their peers and granular insight into client budgets and behaviours.

The findings of the latest jfdi/Opinium New Business Barometer sparked an insightful discussion at a virtual round table chaired by Propeller’s Chief Growth Officer and BD100 Co-Founder Jody Osman this week.

The Barometer takes a deep dive into the trends important to new business and its latest iteration received the biggest response ever with 266 agencies providing useful data.

Giving their thoughts on the findings were BD 100 Rising Star and Senior Manager, Business Growth at Ketchum Myreete Stanforth and BD 100 Hall of Famer and Chief Growth Officer at Cyber-Duck Siji Onabanjo, together with Mark Clark, CEO of jfdi.

Opinium’s Josh Glendinning laid out top line findings from the wealth of information in the report. These included:

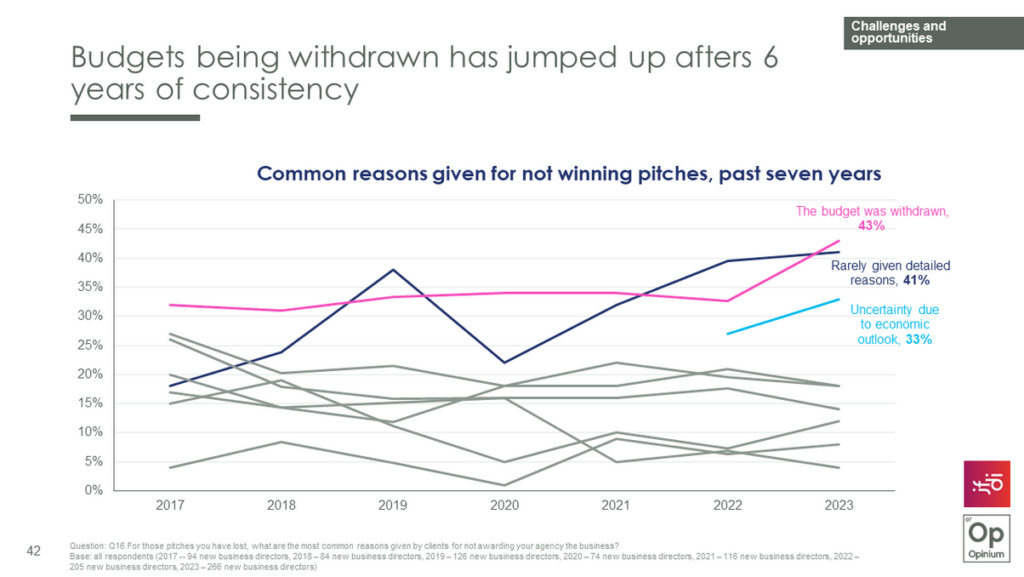

- In a tough economic environment, there have been sharp increases in the number of agencies citing economic uncertainty (33%, up 6pp) and withdrawn budgets (43%, up 10pp) as reasons they have not won pitches.

- Meanwhile, more agencies are citing deliverable/practical/affordable ideas (33%, up 8pp), alongside relevant expertise/capabilities (73%, up 6pp) as the reasons behind successful pitches.

- More than two-thirds (70%) of new business practitioners say their job has become more stressful in the past year.

- For the first time in 5 years, there has been an increase in new business targets for smaller agencies (£784k, up 9%), but a fall in targets among medium (£2.9m) and large agencies (£5.4m).

- Medium agencies now spend less on marketing as a proportion of their new business revenue target (3.1%) than large agencies (4.5%), a shift from previous trends.

- Personal connections remain most widely used (88%) and most valued (44%) prospecting strategy for agencies, despite automation efforts.

- Small and medium-sized agencies are prioritising filling the pipeline (both 77%), while large agencies are more focused on converting pitches (48%) and growing existing clients (17%).

- Large agencies appear to be pursuing lower value opportunities on average (£148k, down 29%), suggesting they may be focusing more on project-based work that was previously the domain of small and medium agencies.

What comprises a winning hand?

The report highlights the biggest challenges agencies are experiencing, including the fact that less than half of the ideas presented in winning pitches see the light of day and there are increasing instances of budget withdrawal post-pitch. The pressures and financial cost of mounting a pitch are taking its toll as well with 70% of business professionals report higher stress levels due to new business challenges.

But the research also surfaces what agencies consider important in growing business. The leading reasons include possessing strong relevant expertise and capabilities and coming up with practical, deliverable, and affordable ideas. Taking advantage of opportunities for organic growth from existing clients also came through strongly.

Focus on qualifying the opportunity

When discussing withdrawn budgets, abandoned pitches and “ghosting” on post pitch feedback the panel focused on the need to have a robust qualifying framework for leads.

Siji emphasised the need for proper due diligence and said: “I think you need to qualify enquiries better, so by the time you get to that pitch stage … at that point the budget should be secured, you should know the budget.”

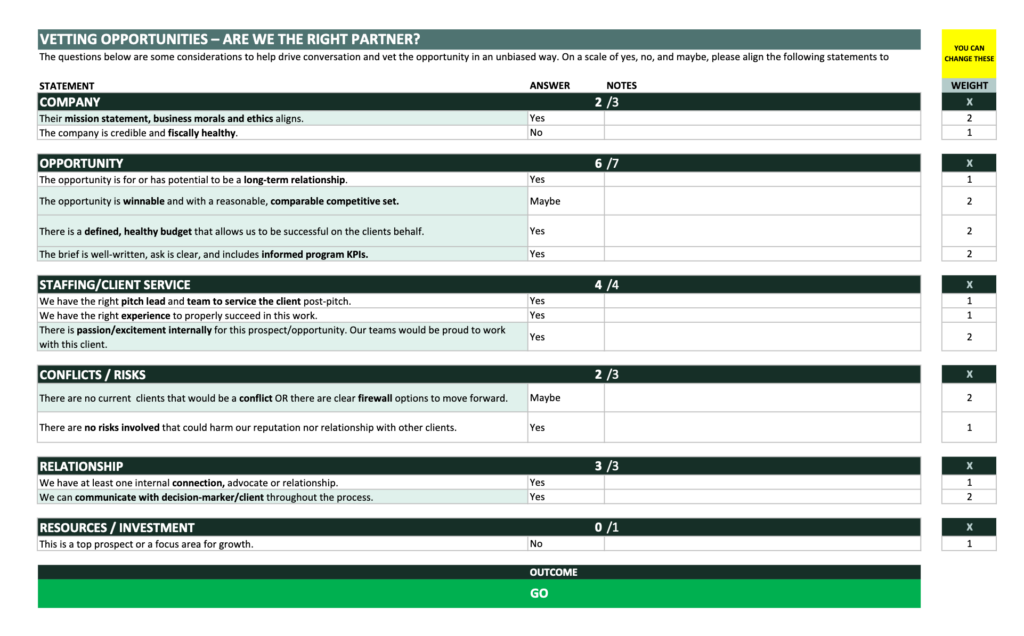

The advice is to put more emphasis on earlier stage questions, know who the decision-makers are and understand the client’s process. There are ‘red flags’ that new business teams should be on the alert for in how the prospect answers your questions – especially if the lead is not willing to share the information necessary to put together a strong pitch.

Myreete highlighted the need for a swift response time to any scope of work request – ideally within two days. She said: “We don’t take two weeks to [develop a scope for our clients], we develop it right away because the client’s finance team needs that strategy and needs to know where the money is being spent to invest in an agency. If you don’t move quickly, you’re out.”

She also explained that she had devised a scoring framework to evaluate leads that provided an immediate ‘stop/go’ response.

Rigorous qualifying also helps make sure resources are better targeted – less can be more if an agency targets bigger opportunities with more certainty of winning. This also means teams don’t burn out so quickly.

Constantly review offerings and organic growth

Siji highlighted the need to be “in sync with client needs.” The point came into sharp focus after he reviewed the level of budgets and enquiries the agency was receiving. Agencies need to ask themselves if the market has moved on are they still offering the right services?

Bringing BD and Growth leaders more into alignment could also be helpful. Organic growth is very important but the report showed relatively few BD teams look to their own client base as a source of leads and enquiries. This may reflect that new business teams don’t have the remit for organic growth and a siloed Chief Growth Officer owns existing client relationships. There is exciting potential for these executives to work more closely together.

Leaning into referrals and recommendations from people in your network shouldn’t be ignored and these relationships can be strengthened by organising events and other face to face possibilities. Siji said: “I think sometimes we forget about that, and I think when times are quieter and there’s not an abundance of leads coming in, the natural thing to do is go within your network and see what’s there… there’s probably a lot of untapped treasure within your networks.”

Power up

It was felt there has been a shift in the power balance in relationships between agency and client in recent years and agencies must be careful not to seem overly desperate in the quest for new business. Neediness undercuts the ability for an agency to hold its position and champion its uniqueness and differentiation the market.

The panel acknowledged the pressures that marketers are under but agreed that agencies able to stick to their standards and a level of high quality will be more viable businesses over the longer term.

To learn more about the findings in the jfdi/Opinium report please contact Mark Clark at Mark@jfdi.uk.com

The ALF Sales and Marketing Awards in association with BD100 and supported by Propeller and jfdi take place on May 1st – you can book a ticket here.